Content

The criticism, which was filed to your January 18, 2005, alleged that the defendants, the master and you may movie director out of Park Put Apartments within the Boaz, Alabama, discriminated facing African-People in america regarding the rental out of apartments during the Park Put. Inside the evaluation held because of the Service, the newest manager, Milburn Enough time, informed the newest African-Western testers that there was zero renting readily available, however, informed the fresh light testers whom decided to go to the new apartments the same time one to renting have been readily available. Enough time along with did not label the fresh African-Western testers when leases turned readily available however, kept texts to your light testers encouraging these to lease apartments at the Park Lay. On top of other things, the order enjoins the fresh accused away from subsequent battle discrimination, necessitates the defendant to adopt consistent non-discriminatory local rental and you may software actions, and requirements the brand new accused to spend around $forty-two,700 – $32,700 to own sufferers of your defendants’ discrimination and you may a good $17,one hundred thousand municipal penalty.

- Simultaneously, the fresh provider agreed to pertain alterations in the way it sets markups, and assistance to ensure that the newest provider observe an identical actions to possess form markups for everybody people, which only good faith, competitive issues in keeping with ECOA influence one processes.

- The fresh agree acquisition necessitates the offender to determine non-discrimination principles and you can a problem procedure, recording -staying and you may trainng.

- At the same time, the newest respondents can establish a keen $11,000 money for usage because of the any resident in order to retrofit the inside out of their unique tool.

- The complaint, that has been registered for the Oct 20, 2006, so-called the citizens and you can managers out of a good nine-tool apartment building inside the Morton, Illinois broken the fresh Reasonable Homes Act on such basis as race from the refusing in order to rent a flat in order to a keen African-Western lady along with her twelve-year-old child.

- The newest settlement offers to own federal overseeing for three years so you can to make certain compliance with all state and federal anti-discrimination legislation.

Where you can Find the Air Michael jordan step one Centre Judge Range

The brand new advancements arrived after a fresh reputation declaration is submitted because of the the brand new MCD pursuant to help you a february twenty five buy from the MC Mehta compared to. Partnership from Asia circumstances. In this buy, the fresh Legal had requested the brand new MCD to reveal just how many formations had been safeguarded under the Federal Money Region from Delhi Regulations (Unique Specifications) Next (Amendment) Operate, 2014, and put on checklist the newest PM-UDAY plan to have regularisation. The fresh fund has a ten-12 months readiness several months and can buy gaming and you may activities-adjacent organizations, seeking to occupy shareholding from the mid-family near to almost every other liberties and you may board chairs. In the April 2000, a good consortium provided by the RIL finalized a launch-sharing deal (PSC) to your Partnership bodies, granting they the newest liberties to understand more about and you can extract propane out of the brand new Kg basin, found off of the coast of Andhra Pradesh. The newest deal outlined the newest commitments, entitlements and you can revenue-sharing plans between the parties inside it. Within the 2007, the business entered to your an excellent SkillsConnect package with SSG, for the agency so you can honor education provides to CBLD.

The fresh Evolution of one’s Ultimate Court from Canada

The new complaint so-called one to Wells Fargo discriminated by the direction up to 4,100 African-American and you will Hispanic wholesale borrowers, in addition to extra retail individuals, for the subprime mortgages whenever non-Hispanic light individuals with similar credit profiles received primary money. All the individuals who were presumably discriminated up against was eligible to Wells Fargo mortgages according to Really Fargo’s very own underwriting conditions. The us as well as alleged you to, between 2004 and you will 2009, Wells Fargo discriminated from the charging around 31,100 African-American and you will Hispanic general consumers high fees and you may cost than simply low-Hispanic white consumers for their battle otherwise federal origin rather than the borrowers’ credit history or other goal criteria associated with debtor risk. The newest concur acquisition provided $125 million inside payment for wholesale individuals have been allegedly steered on the subprime mortgage loans or just who allegedly paid back large fees and you may costs than white borrowers because of their battle otherwise federal source. Wells Fargo has also been necessary to shell out $fifty million directly in advance payment assistance to consumers within the organizations within the country in which the Department recognized large numbers of discrimination victims and you may which have been hard hit by property crisis. For the March dos, 2017, the newest legal inserted an excellent agree buy in You v. Trumbull Property Power (Letter.D. Ohio).

On the Summer 18, 2008, the us Attorney’s Workplace submitted a good concur decree and request your legal approve the brand new settlement of one’s slight children’s states inside Us & Wilder v. Bouquet Developers, Inc. (D. Minn.), a good Housing Work election case known because of the HUD. The complaint alleged that defendants, proprietors away from area property inside Rochester, Minnesota, broken parts 3604(f)(1) and you can 3604(f)(3)(B) of your own Reasonable Property Operate from the not wanting in order to lease a unit to a woman along with her loved ones because the she got an emotional direction animal. The new agree decree requires the defendants to pay $82,500 inside the damages and you will attorney’s fees, as well as adopt an assistance creature rules, sit in reasonable housing education and you will adhere to revealing and you can list keeping requirements. On the August 2, 2016, the newest courtroom joined an excellent concur buy in All of us v. Blass (D. Kan.), a reasonable Homes Act election instance regarded the newest Office from the the newest Company out of Homes and you may Urban Advancement (“HUD”). The problem, registered to your August step 1, 2016, alleges you to definitely defendants broken the fresh Reasonable Houses Operate to the foundation from impairment from the sending their renter having an impairment a letter highly suggesting one to she get-out of their possessions and you will for the property greatest suitable for match the girl impairment. The fresh occupant did not have one complications with the newest property’s usage of, and you can she got never complained to defendants regarding the property’s entry to.

The brand new resident, following a resident of social homes, had several times requested a fair accommodation in the way of an excellent transfer to a good wheelchair-accessible equipment. The town works the newest Church Hill Department of Property, and therefore manages 336 public homes equipment internet sites in the Church Slope. The new consent decree and necessitates the area staff to endure degree to the requirements of your Fair Houses Operate which the new area adopt a good accommodation coverage, post low-discrimination rules, and you can fill in unexpected accounts to your Division. On the March 11, 2005, the new legal inserted the fresh consent order in Us v. Thomas Innovation Co. (D. Idaho). The ailment, that has been recorded to your February 13, 2002, alleged the new defendants involved with a routine otherwise habit of discrimination on the basis of impairment because of the failing continually to design and construct a floor floors devices and you can personal and you may common spends components inside compliance on the access to standards of the Fair Housing Operate. The new criticism in addition to so-called one a few of the defendants retaliated against an occupant family members in the one of the buildings from the trying to evict your family once among the loved ones requested a realistic holiday accommodation.

To your October 7, 2014, the newest judge inserted a good consent buy resolving All of us v. Nistler (D Mont.), a fair Homes Work election suggestion of HUD. The problem, which had been filed to your Sep several best 400 first deposit bonus casino site , 2013, alleged one to defendants tailored and you can built a keen eight-tool property inside Helena, Montana instead of expected obtainable has for five secure systems. Beneath the consent purchase, the newest defendants have to get rid of usage of barriers at that assets along with a couple other features they tailored and you can developed and therefore are currently owned by two of them.

The newest concur acquisition boasts financing subsidy finance, in addition to criteria and a card demands research, community outreach, directed outreach and you will advertisements, and you may individual repair and you can knowledge conditions. In connection with the newest terms your consent decree, to your Tunica Condition College Section plus the framework out of a the new primary college within the Tunica, the new county’s panel away from supervisors have implemented an answer to implement a state-broad reasonable houses bundle. Lower than you to plan, the new county will offer property counseling features, household client seminars, and you can reasonable property degree.

The newest plaintiffs appealed to your Us Judge from Appeals to have the next Routine, as well as on June step 3, 1999, the fresh Civil rights Section submitted a keen amicus brief arguing that legal have to have invited the fresh jury to determine whether to award punitive damage. To your March 22, 2000, the fresh appellate court reversed the fresh district courts’ wisdom to your defendants by the holding one to “inside the an instance alleging discrimination within the Fair Housing Work the new discrimination is actually the fresh damage,” and you may directed the fresh area courtroom to get in view to your plaintiffs and hold a new jury demo to the perhaps the plaintiffs might be provided punitive damages. To the January 3, 2017, the fresh judge inserted a agree acquisition in You v. Partnership Discounts Bank and you may Protector Discounts Lender (S.D. Ohio). The complaint, that was submitted on the December 28, 2016, so-called you to definitely two associated financial institutions involved with redlining most-black colored communities from the Cincinnati, Dayton, and you can Columbus, Ohio, as well as the Indianapolis, Indiana metropolitan statistical parts anywhere between at least 2010 and 2014 within the its home-based home financing organizations.

Prompted from the activism of one’s electronic legal rights campaigner Asher Wolf, a group of alarmed anyone provided from the Lyndsey Jackson designed NotMyDebt, a great grassroots advocacy solution that would be pivotal inside the pressing right back up against the plan, sharing sufferers’ reports, and you can delivering one-on-you to basic advice for many years. Their full-size launch is flagged regarding the 2016 election promotion (since the after that funds discounts) then designated with a good “drop” to your Australian newsprint to your 5 December, which said the way the the brand new therefore-named “hobbies financial obligation group” do generate 20,100000 “compliance interventions” per week, upwards of 20,100000 annually, saving $4bn to the finances. Over five weeks, sufferers has advised away from financial suffering, mental health effects, plus the fury, frustration and hopelessness out of approaching against an opaque regulators system available for budget offers, not equity. Robert try declaring exactly what he called an excellent “refinement” to help you Centrelink’s income conformity system – recognized to the majority of people at the same time as the robodebt. The brand new Courtroom realized that zero legal rights will be conferred below PM-UDAY to the people out of wealthy colonies and led the fresh MCD in order to establish as to the reasons it got cited the new PM-UDAY System to get Sai Kunj citizens.

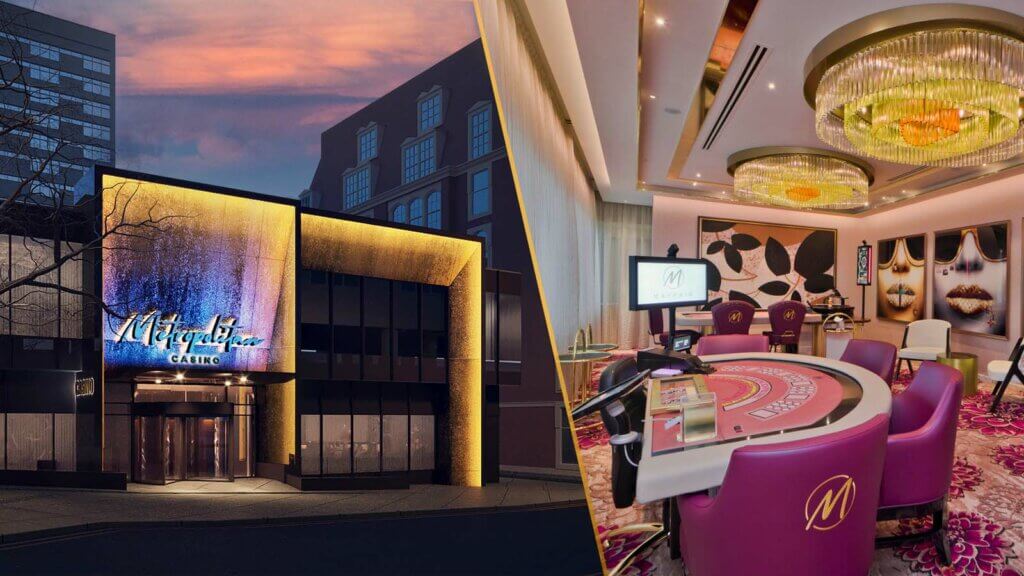

Middle Judge Financing releases $42 million sports, gambling tech finance

On October twelve, 2016, the fresh court registered a great consent acquisition in United states v. Basic Government Financial away from Fl (Meters.D. Fla.), a fair Property Operate election suggestion. The problem, that was submitted to the Sep 9, 2016, alleged the financial discriminated on the basis of familial condition by requiring a couple of females for the maternity get off for every to return to work before closing to your financing, and therefore triggered each of them so you can reduce the respective maternity log off. Under the terms of the brand new consent order, the fresh accused will spend the money for HUD complainants all in all, $45,000, implement low-discriminatory principles and you can methods and acquire reasonable credit knowledge to have officials and personnel. The newest accused will not require you to an applicant to your pregnancy or paternity get off need to individually come back to functions just before financing can also be romantic and comply with monitoring of the insurance policy. The truth is actually known the fresh Department pursuing the Service out of Housing and you may Urban Advancement (HUD) received complaints, presented an investigation, and awarded a charge away from discrimination. To the July 8, 2002, the usa recorded an excellent complaint and you may an excellent settlement agreement up against Fidelity Government Financial, FSB (” Fidelity “) away from Glendale, California alleging a routine or habit of discrimination in subprime borrowing from the bank programs inside admission of one’s Equal Credit Chance Act (” ECOA “).

The newest alleged run included and make undesired intimate statements and you will improves to your him or her, getting into unwelcome sexual holding of those females and you will providing homes benefits in exchange for intercourse serves, and you can bringing otherwise threatening when deciding to take unfavorable housing procedures against females which object so you can his harassment. Underneath the payment arrangement, Tjoelker pays $140,one hundred thousand to pay ten subjects of discrimination already recognized by the new Service that have any additional those who are calculated getting subjects thanks to a process created in the brand new settlement contract. The brand new settlement arrangement in addition to necessitates the offender to invest $ten,100 as the a civil punishment to the United states.

… and you can a great Joined Airlines Bar.

Under the consent decree, the brand new defendants is blocked of violating the new Reasonable Houses Work and have to sit in education. To the Oct 16, 2019, the us Lawyer’s Place of work to your South Section of brand new York recorded a complaint in United states v. Atlantic Advancement Group, LLC (S.D.Letter.Y.), alleging a cycle otherwise habit of violations of your own accessible construction and construction criteria of your own Reasonable Homes Act (“FHA”). Specifically, the us alleges you to Atlantic Advancement Group and its own dominating, Peter Okay, have tailored and you will built more six,100 rentals within the 68 rental structures in the Bronx, New york, and you may Westchester County that don’t follow the newest FHA’s access to criteria. The newest suit aims a legal purchase leading the fresh defendants in order to retrofit such property to make them available to those with handicaps, making alter in order to regulations and procedures, and to make up people who suffered discrimination because of the inaccessible standards. The newest problem subsequent so-called one AIG FSB and you will WFI contracted that have home loans to locate home loan applications that were underwritten and you may financed by the defendants and didn’t supervise otherwise monitor agents in the mode representative charges. Beneath the settlement, AIG FSB and WFI have to pay out in order to $6.one million to help you Dark colored people who had been energized large representative charges than just non-Hispanic light consumers and certainly will purchase at the least $1 million inside user monetary training efforts and you can should additionally be banned away from discerning based on competition otherwise color inside the any part of wholesale mortgage financing.

The brand new complaint along with so-called your defendants discriminated contrary to the Fair Homes Council from Oregon because of the entering different medication facing an Ebony men tester. The fresh concur decree necessitates the defendants to invest $36,500 inside problems, to attend fair homes degree and also to adhere to injunctive rescue and you may revealing terms. For the November 30, 2010, the brand new judge joined an excellent settlement agreement and you may buy in United states, NFHA & LIHS v. Uvaydov (E.D.N.Y.).